Category Archives: Default

Death of Mortimer Caplin

I worked at Caplin & Drysdale in the early 1980s, and I agree with Scott Michel (who started the same year I did but stayed a lot longer, and is quoted in the above article) that Mort set a crucial positive tone regarding the office atmosphere, as well as one about serving clients assertively if needed but ethically. He was also affable and charming, including to junior associates.

Only on one occasion did I work with Mort directly on a project, but it left a good taste. He was interested in a live issue at the time, concerning the IRS’s ability in audits to access tax accrual workpapers that a given taxpayer’s accountants had used to evaluate tax risks for financial accounting purposes.

Mort was thinking about pursuing in litigation a legal position to the effect that the IRS should generally be denied access to such workpapers, on the view that allowing it would undermine financial accounting by inducing accountants (or taxpayers in discussions with them) to pull punches regarding soft spots, the taxpayer’s possible settlement strategy, etc.

This concern is clearly a meaningful one, even if on balance one nonetheless favors granting access. But my task (obviously) wasn’t to figure out what I thought about the merits, but rather to look at precedents, etc., for a sense of how strong the case would be. I concluded from my research that, based on the case authorities etc. to date, the IRS was extremely likely to win on this issue. (As indeed was soon confirmed – see U.S. v. Arthur Young, decided by a 9-0 Supreme Court in 1984.)

After working all day on a Saturday or Sunday to finish the memo, I per instructions took a taxi up to Mort’s rather nice home (in NW Washington, I think? – but I could be mistaken) to hand him the memo and briefly discuss it. Given the circumstances, I was grungily dressed and unshaven, and I recall having a harder time getting a cab to stop for me than would usually have been the case when I was wearing my regular weekday suit and tie.

When I got there, Mort, though gracious, was clearly not pleased with my conclusion, as it was not what he wanted to hear. But I got the sense that he accepted both its legitimacy (although obviously he didn’t read it in detail until I had left), and that I had properly done my job.

Fall 2019 NYU Tax Policy Colloquium schedule

The French digital services tax

I’m still trying to learn more about the tax (my French might not be good enough for reading an untranslated text to do me much good). But it is summarized, for example, here,

The NYT discusses the possible U.S. response – tariffs, of course, as no matter the question they are often the current Administration’s preferred answer – here.

Perhaps unusually among tax experts (and Americans!), I am inclined to be sympathetic to properly designed DSTs, for reasons that I discussed here and here in response to Wei Cui’s very interesting paper on the topic (presented this past April 30 at the winter-spring 2019 NYU Tax Policy Colloquium). And I also think that an aggressive American response would be unwise, among other reasons because our friends – as I hope they still are – across the pond are addressing reasonable concerns about tax avoidance and locally generated rents.

The French DST appears to be aimed primarily at the likes of Facebook and Google Per the EY summary (and translation of some provisions) that I linked above, it would apply to:

1. “The supply, by electronic means, of a digital interface that allows users to contact and interact with other users, including for the delivery of goods or services directly between those users.”

2. “Services provided to advertisers or their agents enabling them to purchase advertising space located on a digital interface accessible by electronic means in order to display targeted advertisements to users located in France, based on data provided by such users. These services include, among others, the buying, stocking and diffusion of advertising messages and the management and communication of users’ data.”

But it would exclude, inter alia, digital interfaces that provide users with digital content, communications services, and payment services (e.g., Youtube, Netflix, and the financial intermediation industry). As I’ll discuss in my article, if one otherwise views the tax favorably, such exclusions may not be well rationalized – leaving aside the financial sector, which might call for separate and more comprehensive treatment.

Obviously this is what they call a developing story, and I’ll try to comment here when appropriate although at the moment I’m more focused on getting my arms around the issues from a broader and more conceptual standpoint.

Rationality wins, for a change

The majority opinion appears to have wholly adopted the viewpoints expressed in amicus briefs that multiple law professors signed, one lead-penned by Clint Wallace (I was among the signatories) and the other by Susan Morse. Whether or not the court thought about it this way, the fact that so many law profs were on one side, without any financial stake, remuneration, etc. (and I believe none were on the other side, at least on this basis) may conceivably have served as a useful signal. There have been quite a few recent international or state tax cases in which law profs were on both sides, and there the proper takeaway was indeed that, in those cases, the merits were far more substantially in dispute among experts than here.

In Altera, the Tax Court unfortunately lost its way, and adopted the views both that stock options cost the issuer zero (in which case I’d like some, please) and that particular details of exchanges between unrelated parties in wholly different contexts should be used mechanically as evidence of “arm’s length,” without an adequate analysis of actual comparability or of how incentives and circumstances might differ as between the settings. The Ninth Circuit’s Altera opinion does a nice job in explaining why the so-called comparable transactions, in which costs of incentive compensation were apparently ignored in particular deals between unrelated parties, weren’t actually comparable in any serious or realistic sense.

The majority opinion also offers a useful and instructive primer on both the history of, and the legislative rationales for, the U.S. transfer pricing rules, in particular as they apply to intangibles. And it sensibly explains why the trap that taxpayers tried to set for the government in the regulatory “notice and comment” stage, by submitting an avalanche of not very relevant material that they correctly guessed the Treasury preamble wouldn’t spend countless pages rebutting point by point, shouldn’t be treated as showing a process failure on the Treasury’s part.

The just-released decision is in effect a do-over. It came out the same way a couple of years ago, but Judge Stephen Reinhardt’s death, after he had signed the majority opinion but before it was reissued, persuaded the Ninth Circuit that the case should be reheard. Given the merits. I’m not at all surprised that Judge Graber, who replaced Reinhardt on the panel, ended up voting the same way.

2019 Law and Society Association Annual Meeting

My talk discussed the completed book, along with what I might (or might not) write about P.G. Wodehouse. Its title is “Reading Wodehouse Seriously (?!),” with the ?! serving to acknowledge the point, why on Earth would one want to be such a spoilsport as to do that? The slides are available here.

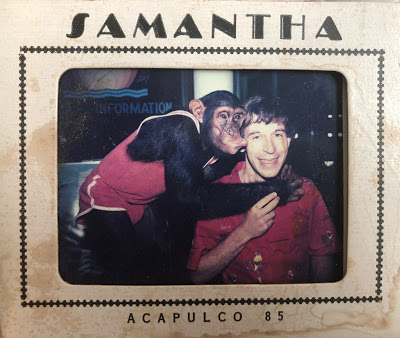

Conference aside, it was nice to be back in Washington (my home base for six years in the 1980s), and I also briefly got to meet these individuals.

The IRS memo on Trump’s taxes

The case that the IRS has to hand over the tax returns is 100% ironclad, since the statute says “shall” and the request is clearly within legitimate Congressional oversight functions.

Mnuchin is being lawless in refusing to comply. It’s true that one generally has the right to contest claims with which one disagrees legally, and then let the courts decide. But here the grounds for objection are frivolous. I thought it was settled back in Magna Carta days, or certainly before the American Revolution, that the Parliament had oversight powers with regard to the executive branch, and the U.S. Constitution clearly reflects a stronger balance of powers commitment than they had in those days across the Pond.

Mnuchin’s position is apparently that Congress has no oversight powers. This is not within the range of debate about what the U.S. Constitution might mean, whatever one’s interpretive theory. And no one at even the very highest levels of the Administration actually believes it, at least in the sense of agreeing that a Democratic president would be similarly exempt from Congressional oversight.

It’s true that Mnuchin is being ordered from above not to comply. But when you receive a lawless order, your choices are to decline to follow it, or else to resign.

The IRS memo has no authoritative legal force as such, but it shows two things. The first is that the IRS lawyers realized how clearcut and indisputable the legal issue is. (The mention of executive privilege presumably reflects a view that such issues would be outside IRS legal expertise, but of course it’s completely absurd to argue that a president could have executive privilege regarding the tax returns he filed as a private citizen, and also no such claim has been made.)

Second, the fact that the IRS memo apparently played no role in the Administration’s, or Mnuchin’s, consideration of what to do unsurprisingly confirms their lawlessness. In an Administration that viewed legality as at least relevant, the memo would have been considered, and if its analysis was rejected that would have been based on non-risible legal arguments to the contrary. That does not appear to be what happened here.

Sticking the ending is tough

Also the burning city was a bit too picturesque. Nicely curated little fires burning at regular intervals near arranged rubble. The set designer needed to go a bit more chaotic and rando.

Considering exercise of the House’s inherent arrest power

I have to admit, I consider it a tough question how this would end up playing out in the public arena, given that these individuals do not seem terribly committed to the rule of law, have armed bodyguards, and would not necessarily agree to go peaceably.

Back in the day