“So, what did you guys do for Father’s Day?”

“We went to Central Park. No meltdowns, it was relatively seamless, couldn’t have been better!”

“So, what did you guys do for Father’s Day?”

“We went to Central Park. No meltdowns, it was relatively seamless, couldn’t have been better!”

It was vacation, except for a talk at Vienna University on my forthcoming international tax paper, at which I learned that, since in a sense it’s two papers (international tax policy lessons of recent years, plus analyzing 3 key provisions in the 2017 act), neither of which is wholly uncomplicated, it’s basically impossible for me to present the whole paper unless I have at least 45 minutes. I did indeed have that much time on this particular occasion. But the next few times I present it, I’ll probably have only 20 minutes, so it appears that I’ll need to jettison one half or the other almost entirely.

Slides for the talk are available here.

Since finishing my article on the international provisions in the 2017 tax act (forthcoming in Tax Notes on July 2 and 9), I’ve mainly been working on my book on literature and high-end inequality. I’m getting towards the finish line for what I see as volume 1, which ends before World War I with literature from the First Gilded Age in the U.S.

But I am heading across the Great Pond tomorrow to spend a week-plus in Vienna, Prague, and Cresky Krumlov (a small and apparently beautiful city in Czechia that is reachable from Prague). The work-related tie-in for this is that on Monday, June 11, I’ll be discussing my international tax paper at a Vienna University Tax Seminar.

Slides for the talk are available here.

I have now completed the piece, and it will be appearing in Tax Notes in two parts, on July 2 and 9.

The two-part publication was necessary due to its length (close to 30,000 words), and made sense due to a natural breakpoint between the two main parts. The first half focuses on international tax policy conundrums and dilemmas in general, and the second half on the BEAT, GILTI, and FDII in particular.

I put both halves of the analysis in the same article due to their complementarity. One needs the first part in order to ground the evaluation in the second part. And I think the second part helps show that the normative discussion in the first part is focusing on things that countries actually care about – which cannot comparably be said about standard-fare generalizations regarding, for example, the supposedly central choice between “worldwide” and “territorial” models, neither of which any major industrial country appears to want in its unalloyed entirety.

While I don’t pull my punches in evaluating the BEAT, GILTI, and FDII, the piece is written in a far kinder, more tolerant, and even verging on forgiving, spirit than my piece on the passthrough deduction. I expressly address in the new piece my reasons for taking a different tone here. I also offer general thoughts regarding how the provisions might be changed or improved, taking the more defensible underlying policy aims as given, albeit without getting into the weeds as some outstanding recent pieces, such as this one, have.

On July 23, with Tax Notes’ permission, I will be posting the article on SSRN. Evidently I’m fine with losing a few downloads under the official count, in exchange for having, I hope, significantly more actual readers.

I’ll also be discussing the piece in Vienna on June 13, in Oxford at the end of June, in Ann Arbor on October 24, and in Copenhagen on November 5. (Time permitting, I’d be happy to add, say, Australia, New Zealand, China, or Japan to the tour, assuming roundtrip business class tickets, but no one has as yet asked.)

Luckily, he doesn’t know what I was doing while away.

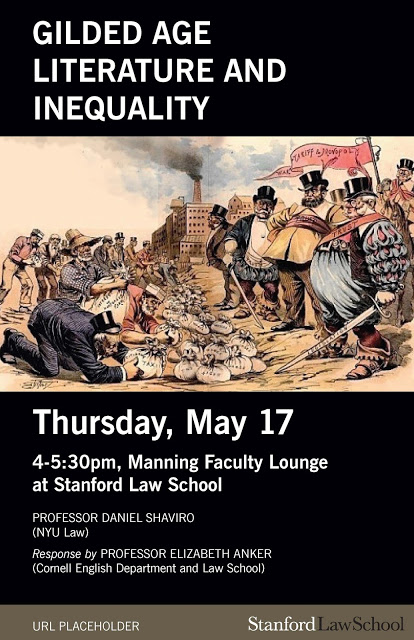

First, on Thursday, May 17, at 4 pm, I’ll be giving a talk entitled “Gilded Age Literature and Inequality.” This relates to my literature book project – now in two parts, with Book 1 to be entitled Dangerous Grandiosity: Literary Perspectives on High-End Inequality Through the First Gilded Age.

I’ll be speaking for up to 40 minutes, and have more or less written up a talk that I may post afterwards on SSRN and/or here. In addition to discussing the project in general, it focuses in particular on my chapter discussing E.M. Forster’s Howards End. Elizabeth Anker of Cornell (both the law school and the English Department) will be the respondent, and then there will be Q and A.

There doesn’t seem to be a link posted yet for this event, but I will provide it here once available.

Then, on May 18-19, there will be a Law and Humanities Conference at Stanford, hosted by Bernadette Meyler of Stanford (who also kindly arranged my literature book event) and Simon Stern of Toronto.

As per the conference program, I’ll be participating, including as the respondent at a May 19 panel entitled “Areas of Substantive Law” that will feature papers by Daniel Williams of Harvard, Andrew Gilden of Williamette, and Sherally Munshi of Georgetown.

I’m looking forward to these events, which I anticipate will be welcomedly (to coin a new word) horizon-expanding.